The 2026 UAE Mortgage Blueprint: Navigating Interest Rates, Rental Shifts, and Market Maturity

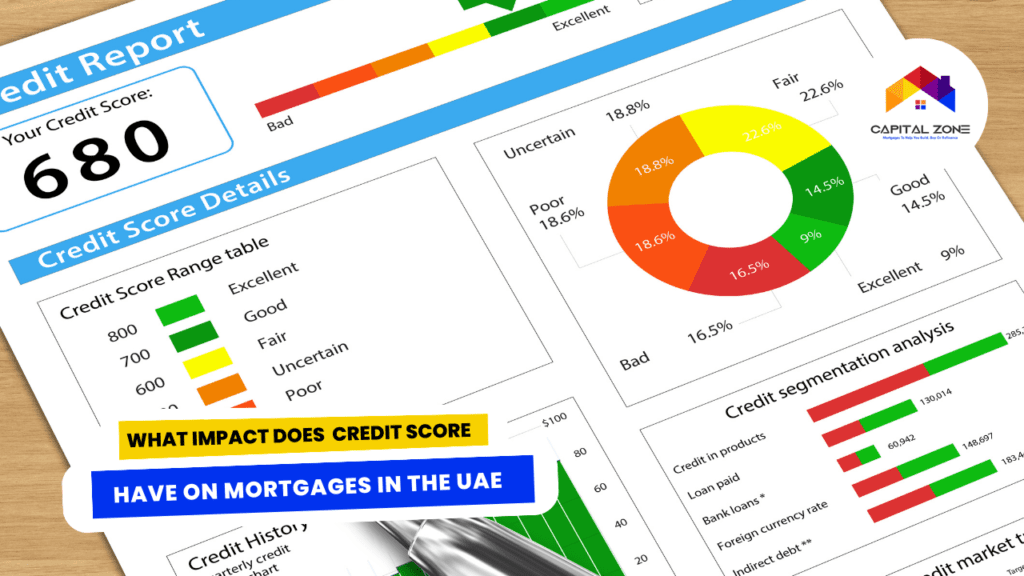

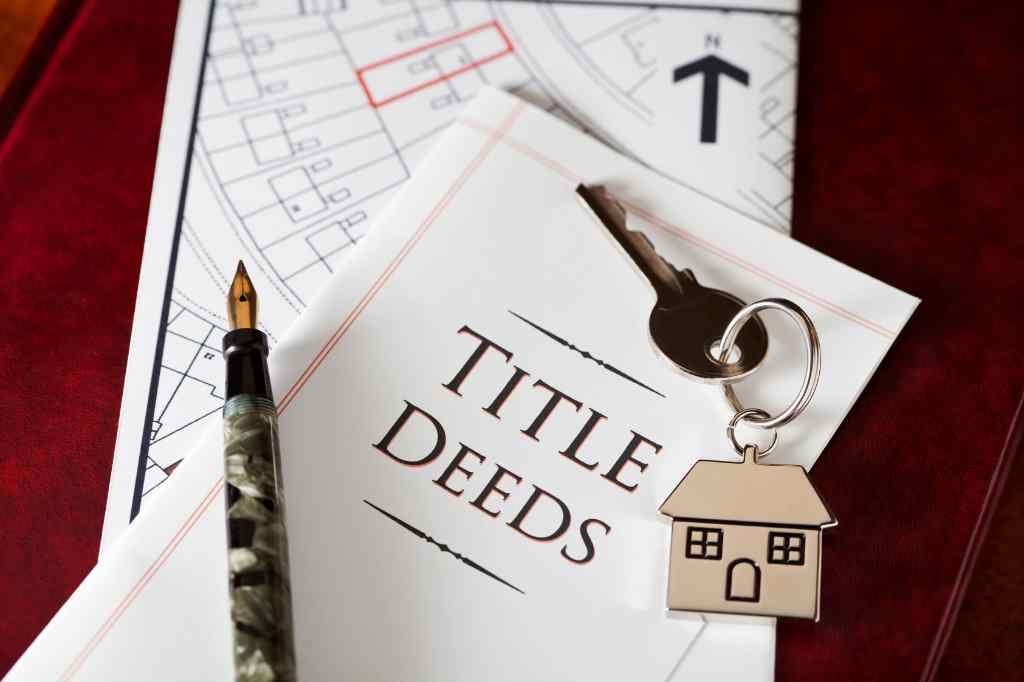

As we move through the first quarter of 2026, the UAE real estate landscape is undergoing a significant transformation, making the expertise of professional mortgage brokers Dubai more essential than ever. For those seeking a reliable mortgage broker, the current market demands a strategic approach to financing that only Capital Zone Mortgage can provide. The “frenzy” of previous years has been replaced by a sophisticated and transparent market; consequently, the most successful buyers this year are those who move beyond basic property searches and dive deep into the financial mechanics of the current lending environment. The “End-User” Era: Why Renters are Becoming Buyers The most defining trend of February 2026 is the stabilization of the rental market. Data from the Dubai Land Department (DLD) suggests that while demand remains high, the aggressive double-digit rent hikes of the past have finally leveled off. However, this stabilization hasn’t made renting “cheap.” In many prime communities—such as Dubai Hills, Town Square, and Furjan—the annual rent remains significantly higher than the cost of a monthly mortgage repayment. This has triggered a massive wave of “rent-to-own” conversions. Residents are realizing that by securing a home loan, they can transition from a tenant to a landlord, building equity in an appreciating asset rather than losing capital to monthly overheads. Significantly, the Central Bank of the UAE (CBUAE) recently reported a historic 6x oversubscription for its latest 7-year Islamic Treasury Sukuk auction, signaling immense liquidity and long-term investor confidence in the UAE’s financial stability. Decoding Interest Rates: What to Expect from the EIBOR Interest rate volatility has been a major concern globally, but the UAE has shown remarkable resilience. In late February 2026, the 3-month EIBOR (Emirates Interbank Offered Rate) is trending toward a more predictable 3.58%. As a leading financial intermediary, Capital Zone is currently facilitating products that offer: 3-Year Fixed Rates: Ranging from 3.85% to 4.10%, providing a “safety net” for families who want predictable monthly outflows. Variable Rate Transparency: Reverting to EIBOR + a bank margin (typically 1.5% to 1.9%) after the fixed period ends. Reduced Processing Fees: Several Tier-1 banks are currently waiving valuation or processing fees to capture the surge in Q1 applications. Mortgage Brokers UAE vs. Developer Payment Plans: A Strategic Comparison One of the most frequent inquiries we receive is whether to choose a developer’s post-handover payment plan or a traditional bank mortgage. While 0% interest sounds appealing, it often hides a premium on the property price. The Mortgage Advantage When you work with a specialist team, you gain access to 25-year tenures. This lowers your monthly installment compared to a developer plan, which typically requires the full balance within 3 to 5 years. Furthermore, a bank mortgage allows for immediate title deed issuance upon handover, giving you full legal security and the ability to resell the property more easily. Why Partner with Capital Zone Mortgage? The mortgage process in the UAE involves multiple stakeholders: the bank, the developer, the DLD, and the valuer. Attempting to navigate this alone can lead to delays or unfavorable terms. Our focus on being the premier Mortgage brokers Dubai reflects our commitment to transparency. Whether you need a mortgage broker for a first-time purchase or a portfolio refinance, Capital Zone Mortgage acts as your primary point of contact for the entire UAE lending space. Frequently Asked Questions (FAQ) What is the current down payment requirement for expats in Dubai? As of 2026, the standard down payment for expatriate residents purchasing their first property (under 5 million AED) remains 20%. For properties exceeding 5 million AED, the requirement typically increases to 35%. UAE Nationals enjoy a lower entry point of 15%. Can I get a mortgage in Dubai if I am a non-resident? Yes. Capital Zone Mortgage specializes in non-resident financing. Generally, non-residents can secure up to 50% to 60% Loan-to-Value (LTV). You will need to provide proof of income from your home country and meet the bank’s minimum monthly income requirements. How long does the mortgage pre-approval process take? With our integrated digital platforms, a pre-approval can be issued in as little as 3 to 5 working days, provided all documentation (passport, visa, salary certificates, and 6 months of bank statements) is ready. Is it better to choose a fixed or variable interest rate right now? In the current Feb 2026 climate, many clients prefer a 3-year fixed rate. This protects you from any short-term EIBOR fluctuations. However, for those with a high risk tolerance or plans to sell the property quickly, a variable rate might offer more immediate flexibility.